ホーム / English

Company Profile

-

- Company Name

- Uni-Asia Capital (Japan) Ltd.

-

- Address

- 5F Hulic Kandabashi Building, 1-21-1 Kanda Nishikicho, Chiyoda-ku Tokyo

-

- Tel

- +81-3-3518-9200

-

- Established

- on November 9, 1998

-

- Paid-in Capital

- JPY100,000,000

-

- Business Segments

- - Origination / arrangement of real estate investment funds

- Real estate asset management

- Advisory / consulting services for real estate investments

- Ship finance arrangement

-

- Parent Company

- Uni-Asia Holdings Limited (100%)

-

- Board of Directors

- President Takeshi Iritono

Chairman Masahiro Iwabuchi (CEO , Uni-Asia Group Limited)

Director Takuro Ishiura

Director Lim Kai Ching (Executive Chairman, Uni-Asia Group Limited)

Director Shinichiro Ishizaki(Uni-Asia Group Limited)

Auditor Masahiko Sano

-

- Licenses

- - Real Estate Brokerage License

- Financial Instruments Business Registration for

・Type II Financial Instruments Business

・Investment Management Business

・Investment Advisory and Agency Business

- Real Estate Specified Joint Enterprise Registration (No. 3 and 4)

- Real Estate Investment Advisory Business Registration

- Money Lending Business Registration

- Rental Housing Management Business Registration

-

- Member of

- Japan Investment Advisers Association

-

- About Uni-Asia

- Uni-Asia Group, established in Hong Kong in 1997 and listed on Singapore Stock Exchange in August 2007, is an alternative investment company specialising in creating alternative investment opportunities and providing integrated services related to such investments. The amount of capital as of December 2023 is US$113,174 thousand.

Our Business

UACJ offer wide range of asset management services in Japan

- Uni-Asia Group is an alternative investment company, listed on Singapore Stock Exchange since 2007, specialising in creating alternative investment opportunities in Shipping and Real Estate across Asia Pacific. We offer a cross border, integrated platform service to our clients in Singapore, Hong Kong and Japan.

Uni-Asia Japan offers a wide range of real estate investments and asset management services across Japan for our clients worldwide. - UACJ have a full line-up of licenses / registrations necessary to render asset management services to investors in relation to property investments in Japan.

– Real Estate Brokerage License

– Financial Instruments Business Registration for

・Type II Financial Instruments Business

・Investment Management Business

・Investment Advisory and Agency Business

– Real Estate Specified Joint Enterprise Registration

– Real Estate Investment Advisory Business Registration

– Money Lending Business Registration - UACJ have more than 20 years of experience and sound track record of managing real estate funds investing mainly in residential and commercial properties including hotels.

- One of UACJ’s core business is the small residential property development business in Metro Tokyo under the brand name “ALERO” (http://www.uni-asia.co.jp/alero/) . Since 2004 to date, over 80 ALERO projects were managed, of which 72 are completed / disposed and remaining under management / construction.

- UACJ also render property management services to new owners for disposed ALEROs and other buildings at the request of each owner. 18 buildings are currently under management, of which 13 as a master lessee, and 5 as a property manager.

- UACJ, as a pioneer in the market, also have a good track record of hotel investment business, with 19 hotel funds since 2001.

- UACJ recently started to manage real estate funds investing in healthcare assets in Japan, currently 15 assets are under management.

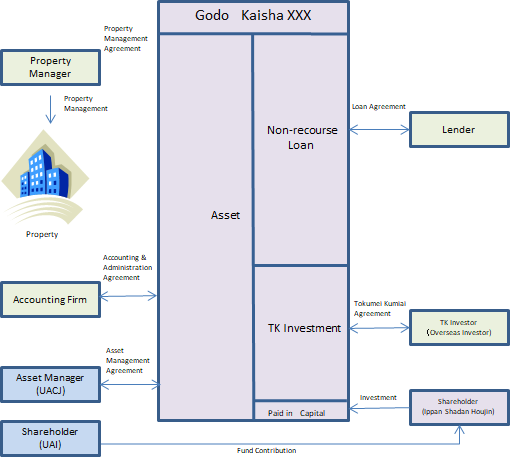

Typical investment structure for overseas investors